PA Corporate Tax Rate Reductions Enacted

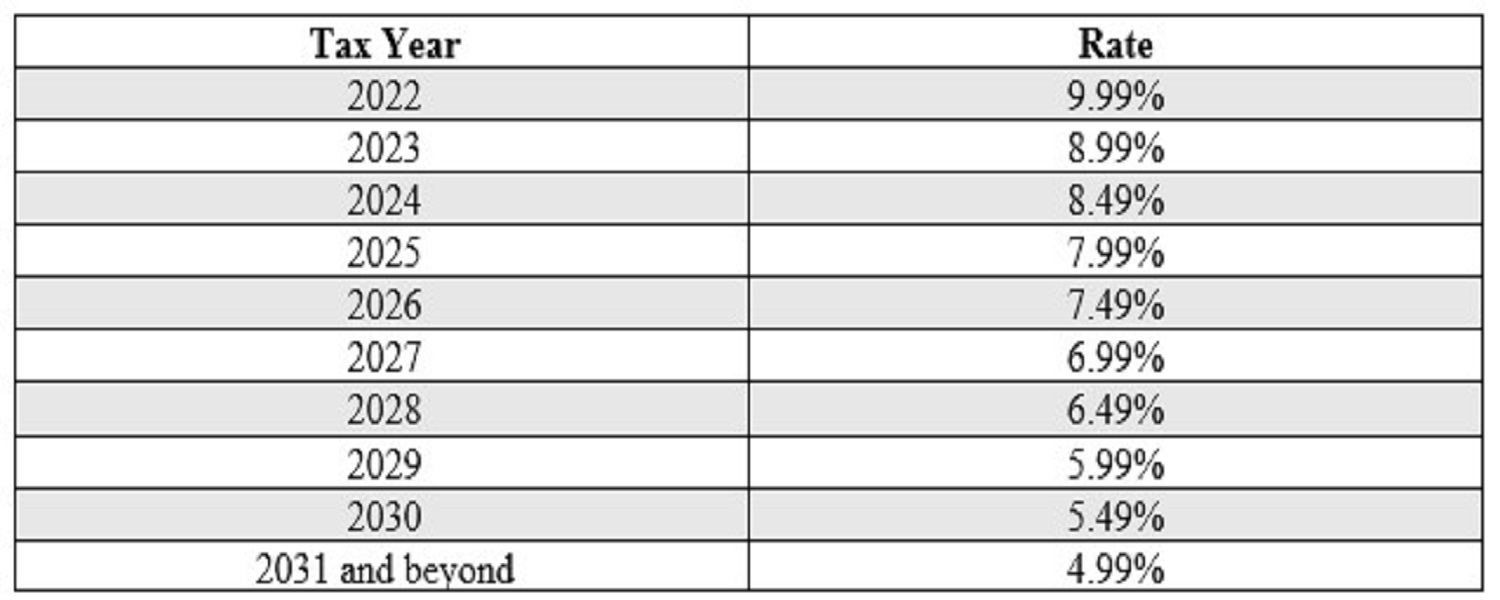

Governor Tom Wolf recently signed legislation that reduces corporate tax rate in Pennsylvania – or the Corporate Net Income Tax (CNIT). The present rate of 9.99% is the highest flat rate in the country and only New Jersey has any corporate tax brackets higher than PA’s 9.99%. The reductions will begin with tax year 2023, where the rate will be 8.99% and then continue downward until tax year 2031, when the rate is 4.99%.

The corporate tax rate is paid by C-Corporations, which include many large corporations and publicly traded entities. The Companies’ presence in PA can improve economic factors, but they often cite the high tax rates in the state as reason not to be more active in the Commonwealth.

The tax rate for pass-through entities, such as partnerships and S-Corporations, remains unchanged at the individual rate of 3.07% because pass-through entities are taxed at the partners’/stockholders’ individual tax rate.

The law that decreased the tax rate also included language that required companies with no location in PA, but at least $500,000 of revenue sourced to PA to register with the state and pay taxes to the Commonwealth.

The below table shows the tax rates as a result of this new law: